Unexpected expenses in Bucharest: how to prepare financially for unpleasant surprises

By Bucharest Team

- Articles

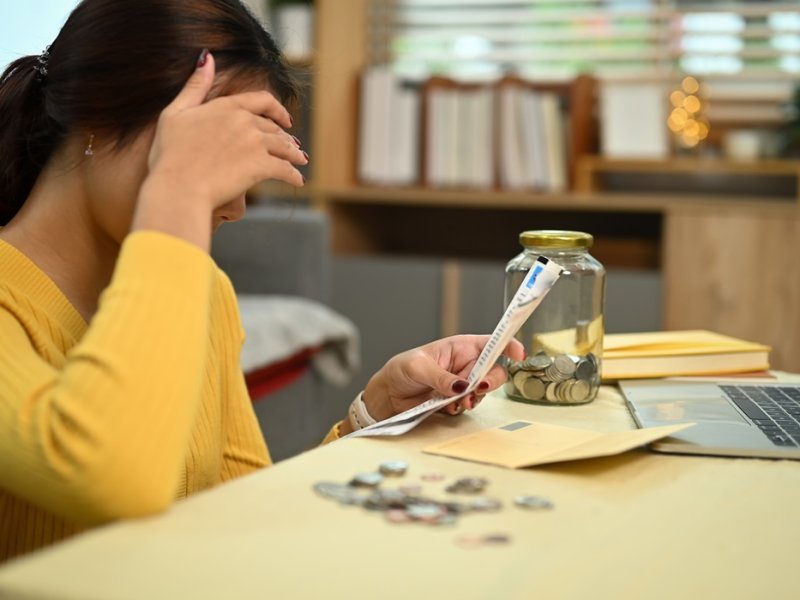

Life in the capital can bring many not-so-pleasant surprises, and some of these can involve unexpected expenses. From urgent car or home repairs, to medical problems or other unforeseen situations, it's essential to be financially prepared.

Here's what we recommend to help you prepare for unexpected expenses and manage unpleasant surprises more easily:

1. Set up an emergency fund

The first step to be prepared for unexpected expenses is to set up an emergency fund, which ideally should cover between 3 and 6 months of living expenses. We know, it sounds complicated, but saving a little bit at a time will give you the security you need to deal with unexpected expenses without going into debt. Put this money in a separate savings account so you won't be tempted to use it for other purposes.

2. Plan and monitor your budget

The month goes by and you have no idea what you spent your entire paycheck on? You're not the only one who does! To better understand where your money is going, create a monthly budget and track your spending. There are many financial management apps like Mint or YNAB (You Need A Budget) that can help you track your income and expenses. By regularly monitoring your finances, you'll be able to more easily identify where you can save money.

3. Don't ignore taking out insurance

No, this practice is not outdated at all! That's because insurance is still an essential tool for financial protection against unexpected expenses. Whether it's health insurance, home insurance or car insurance, it can help you avoid large out-of-pocket expenses in an emergency. We also recommend that you review your insurance policies to make sure you have the coverage you need.

4. Preventive maintenance can help

Another way to avoid unexpectedly large out-of-pocket expenses is to invest in preventive maintenance on your home and car. Schedule regular inspections and fix small problems before they become major and costly. This can help you save money in the long run and prevent inconvenience.

5. Explore additional sources of income

Saving can sometimes mean working a little harder. Having extra sources of income can be very helpful in managing unexpected expenses. Try different part-time jobs, freelancing or selling things you no longer need. Extra income can be added to your emergency fund or used to cover unexpected expenses.

6. Look for the best price and negotiate

When you're faced with an unexpected expense, such as a major repair, don't rush to the first offer. Ask for several quotes and compare prices. And, believe it or not, negotiating can help you get a better price and save you considerable money.

7. Invest in financial education

Maintaining a good financial education is essential for managing unexpected expenses effectively. Attend personal finance courses, read relevant books and articles and follow the advice of financial experts to stay informed and prepared.

Unexpected expenses are inevitable, but with proper financial preparation, you can reduce the stress and impact of these situations. Remember that you are on a more secure and stable financial path. Life in Bucharest can be full of challenges, but with these strategies, you'll be better equipped to face them and enjoy every moment in the city. Take care of your finances and prepare for any surprises!

Also recommended: What it's like to live in Bucharest: A complete guide to monthly expenses